The Crypto Fear & Greed Index offers a unique lens through which to view the often turbulent and emotion-driven world of cryptocurrency trading. This index is not just a number; it’s a reflection of the collective emotional state of Bitcoin and other significant cryptocurrency’ investors. By aggregating various sentiment indicators, the index provides a single, easily digestible score that ranges from 0 (representing extreme fear) to 100 (indicating extreme greed).

This tool is invaluable in a market that is notorious for its volatility and susceptibility to emotional trading. It serves as a compass, helping to navigate through the fog of market hype and panic. By understanding the underlying emotions driving market movements, investors can make more informed decisions, avoiding the common pitfalls of fear-based selling and greed-fueled buying.

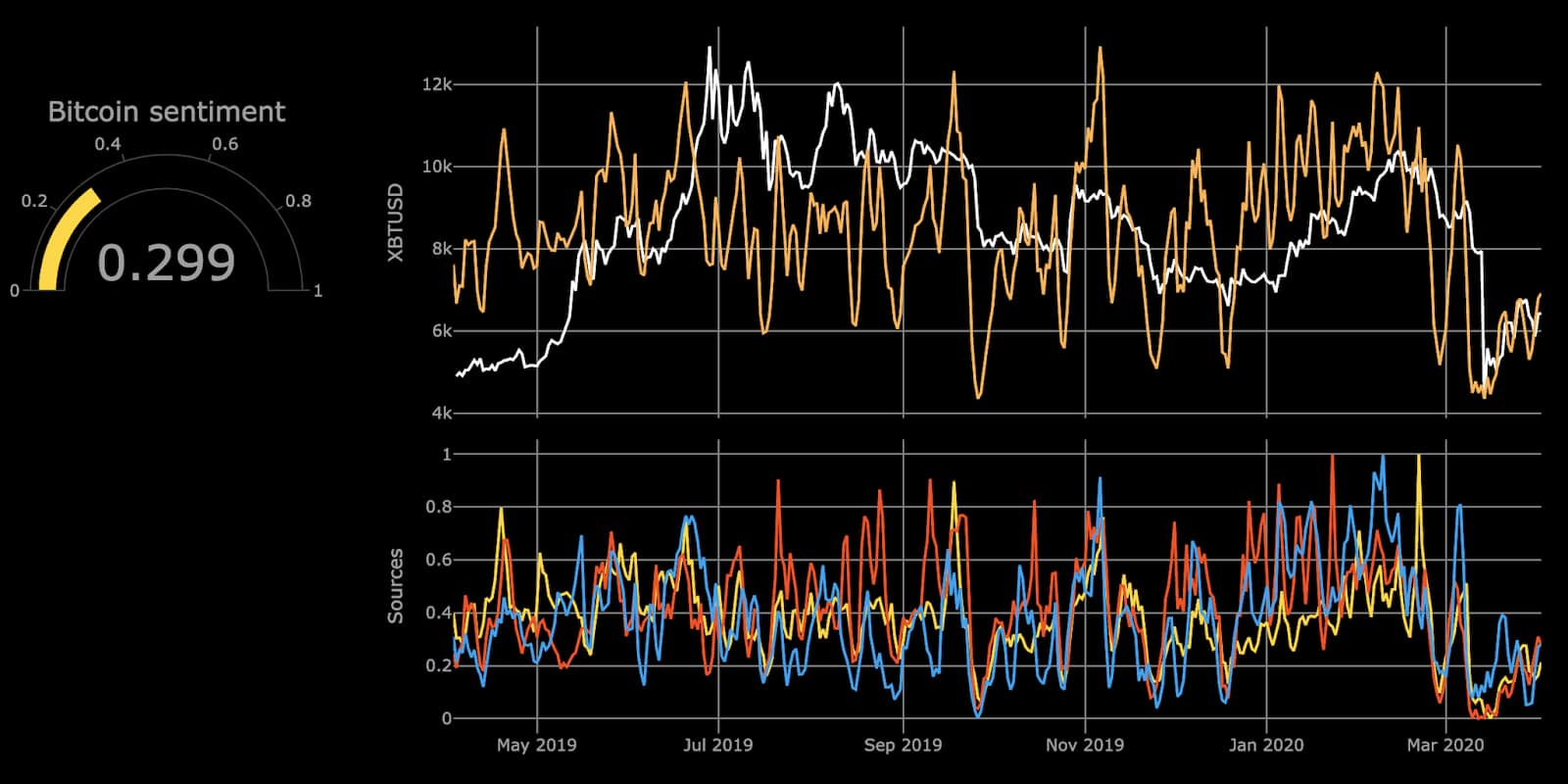

Daily Index Analysis and Historical Context

Each day, the Fear & Greed Index paints a picture of the current market sentiment, offering a real-time snapshot of investor emotions. But its value extends beyond the present moment. By tracking the index’s historical values, investors can gain perspective on how current market conditions compare to past trends.

For instance, a current reading of ‘Greed’ might not be alarming in isolation. However, if this reading is part of a consistent upward trend from ‘Fear’ over several weeks, it could signal a growing bubble about to burst. Similarly, a prolonged period in the ‘Extreme Fear’ zone might suggest a market overreaction, presenting a potential buying opportunity.

The index’s historical data thus acts as a roadmap, providing context and helping investors identify cyclical patterns in market sentiment.

Importance of Sentiment Analysis in Crypto Markets

Sentiment analysis is crucial in cryptocurrency markets due to their speculative nature and susceptibility to emotional trading. Unlike traditional markets, crypto markets operate 24/7, with news and social media playing a significant role in shaping investor sentiment. Rapid shifts in sentiment can lead to equally swift price movements, making it essential for traders and investors to stay attuned to the prevailing mood of the market.

The Fear & Greed Index serves as a barometer of these shifting sentiments. By quantifying emotions, it offers a more objective view of the market’s psychological landscape. This insight is especially valuable for identifying when the market’s emotions are at extreme levels, which often precede significant price reversals.

Diverse Data Sources for Index Compilation

The robustness of the Fear & Greed Index stems from its comprehensive approach to data sourcing. The index considers a variety of factors, each contributing to the overall sentiment score:

- Volatility: High volatility is often a sign of a fearful market. The index measures Bitcoin’s current volatility and compares it to historical averages to gauge market anxiety;

- Market Momentum/Volume: This factor assesses whether current buying volumes and market momentum are disproportionately high, suggesting excessive optimism or greed;

- Social Media Analysis: Platforms like Twitter provide real-time insights into public sentiment. The index analyzes tweet volumes, hashtags, and interaction rates to gauge public interest and sentiment toward Bitcoin;

- Dominance Trends: Changes in Bitcoin’s market cap dominance are analyzed to understand if investors are favoring Bitcoin (indicating fear) or riskier altcoins (suggesting greed);

- Search Trends: Data from Google Trends is used to monitor the frequency and nature of Bitcoin-related searches, offering clues about public interest and sentiment shifts.

Detailed Methodology of the Fear & Greed Index

The methodology behind the Fear & Greed Index is a finely-tuned balance of various market indicators. Each component is weighted to reflect its importance in the overall sentiment analysis:

- Volatility (25%): Examines Bitcoin’s current price fluctuations and compares them to historical averages;

- Market Momentum/Volume (25%): Assesses buying volumes and market momentum against the averages of the past 30 to 90 days;

- Social Media (15%): Analyzes interactions and trends on platforms like Twitter to gauge public interest and sentiment;

- Dominance (10%): Looks at Bitcoin’s market cap share as an indicator of investor preference towards safer or riskier crypto assets;

- Trends (10%): Utilizes Google Trends data to understand the public’s search interest in Bitcoin-related topics.

Strategic Application: Trading Insights from the Index

For traders and investors, the Fear & Greed Index is more than just a sentiment indicator; it’s a strategic tool. Understanding market sentiment can help in timing market entry and exit, identifying potential turning points, and avoiding emotional traps. Key applications include:

- Spotting Market Extremes: Extreme values in the index often indicate unsustainable market conditions, either overly fearful or excessively greedy. These extremes can signal potential market reversals;

- Contrarian Strategies: Savvy investors may use the index to adopt contrarian positions, buying during periods of extreme fear and selling during excessive greed;

- Risk Management: The index can be a valuable component of a broader risk management strategy, helping investors assess the emotional temperature of the market and adjust their positions accordingly.

Interactive Tools: Widgets and API Features

The Crypto Fear & Greed Index goes beyond being a static analytical tool. It offers interactive features such as embeddable widgets and a comprehensive API. These allow users to integrate the index into their websites, apps, and trading platforms, providing real-time access to this crucial market data.

- Widgets: Users can embed live-updating or fixed-date Fear & Greed Index widgets into their websites, providing visitors with up-to-date market sentiment data;

- API Access: The index’s API provides developers with a way to incorporate the index data into their applications, allowing for the creation of custom tools and analytics platforms.

Disclaimer and Responsible Usage

It is essential to recognize that the Fear & Greed Index is a sentiment analysis tool, not a financial advisor. Users should not solely rely on this index for investment decisions but use it as one of several tools in their analytical arsenal. Consulting with a financial advisor and conducting thorough research are always recommended before making investment decisions.

Best Crypto APIs: Enhancing Market Analysis

In addition to the Fear & Greed Index, numerous other crypto APIs offer valuable insights into the market:

- CoinGecko API: Provides comprehensive data on cryptocurrency prices, volumes, market caps, and more;

- CoinMarketCap API: Offers detailed cryptocurrency market data, including price trends, trading volumes, and market dominance;

- Binance API: Gives access to real-time trading data, account information, and automated trading on the Binance platform.

Comparative Analysis: Fear & Greed Index vs. Other Sentiment Tools

To understand the unique value of the Fear & Greed Index, it is useful to compare it with other sentiment analysis tools. The following table highlights key differences:

| Feature | Fear & Greed Index | Other Sentiment Tools |

|---|---|---|

| Data Sources | Volatility, Market Momentum, Social Media, Dominance, Trends | Primarily social media and news analysis |

| Market Focus | Bitcoin and Major Cryptocurrencies | Often broader, including altcoins and tokens |

| Update Frequency | Daily | Varies, some in real-time |

| Historical Context | Provides historical values for trend analysis | Often limited to current sentiment |

| User Accessibility | Widgets and API for easy integration | Typically available through specific platforms |

Video Guide

To answer your questions in more detail, we have prepared a special video. Enjoy watching it!

Conclusion

In the dynamic and often unpredictable realm of cryptocurrency trading, the Crypto Fear & Greed Index stands out as a beacon of insight, guiding investors through the tumultuous waters of market sentiment. This comprehensive tool transcends mere numerical data, offering a nuanced view of the emotional undercurrents that drive market trends. By integrating a variety of data sources, from market volatility to social media trends, the index presents a multi-faceted picture of investor sentiment, crucial for making informed trading decisions.

The practical applications of the Fear & Greed Index are manifold. For the astute trader, it serves as a compass, indicating when the market is veering towards irrational exuberance or unwarranted pessimism. It empowers investors to identify potential market extremes, adopt contrarian strategies, and refine their risk management tactics. The index’s daily updates and historical context provide a temporal depth, enabling traders to discern long-term trends from fleeting market moods.