In this analysis, the calculations have been performed to determine the maximum profit achievable from mining Monero, and the findings are not particularly promising. Utilizing the most efficient CPU currently available in the market, the maximum daily earnings stand at 30 cents. Although this technically registers as profitability, the implication is that it would take over five years to recoup your initial investment. Unless you have access to exceptionally inexpensive electricity or there is a significant resurgence in the price of Monero (XMR) to surpass $200, the prospect of mining Monero does not seem financially viable. Exploring the profitability of Monero Mining provides valuable insights as we delve into the world of Chainlink mining, aiming to maximize profit. Let’s delve deeper into the numerical breakdown.

Evaluating Monero Mining Efficiency Across Various CPUs

An examination of the leading Monero mining devices was conducted, inputting key performance indicators into a Monero mining profitability calculator. These metrics included:

- Miner’s Hashrate expressed in kH/s;

- Power usage in Watts;

- Cost of electricity per kWh;

- Fees associated with mining pools.

The findings span a range of mining setups, detailing their profitability.

Profitability of Monero Mining

| CPU | Profit per year ($) | Breakeven in years | Yearly ROI (%) |

|---|---|---|---|

| Bitmain X5 | 305 | 12 | 8 |

| AMD Threadripper 3990X | 136 | 22 | 5 |

| AMD Ryzen 9 5950X (1st entry) | 68 | 7 | 15 |

| AMD Ryzen 9 7950X | 103 | 6 | 18 |

| AMD Ryzen 9 3950X | 35 | 16 | 6 |

| AMD Ryzen 7 5800X3D | -40 | Never | -13 |

| AMD EPYC 7742 | 16 | 56 | 2 |

| AMD Ryzen 9 5950X (2nd entry) | 12 | 38 | 3 |

| Intel Core i9-10900K | -90 | Never | -32 |

| AMD Ryzen Threadripper 2950X | -119 | Never | -11 |

The presented table is predicated on the valuation of a single XMR coin at $150, with electricity costs pegged at $0.12 per kWh, mining pool fees at 1%, and the mining difficulty level set at 362G. It is important to note that while software fees have been presumed to be non-existent in this scenario, some mining software, such as XMRig, may incur additional costs amounting to 1%. For further information, refer to the detailed post on the most effective Monero mining software.

Within these parameters, the Bitmain X5 emerges as the most profitable machine, albeit its cost remains considerably high. When it comes to hardware for XMR mining, the AMD Ryzen 9 7950X stands out, offering a yearly profit of $103, an impressive ROI of 18%, and a breakeven point of just shy of 6 years.

An update to the analysis reveals that the numbers previously mentioned might be somewhat optimistic, being derived from laboratory conditions. Real-world benchmark data suggest that a realistic expectation would be an ROI in the range of 6-8% annually, with a breakeven period extending beyond a decade. This updated analysis can be found here.

While an 18% return is attractive—certainly, an 18% yield on a stock or ETF would be cause for celebration—in the realm of cryptocurrency mining, the standard for large mining operations is to achieve breakeven within a year.

It is beneficial to scrutinize the inputs closely to determine whether Monero mining is a viable and sensible endeavor.

Key Determinants Impacting Monero Mining Profit

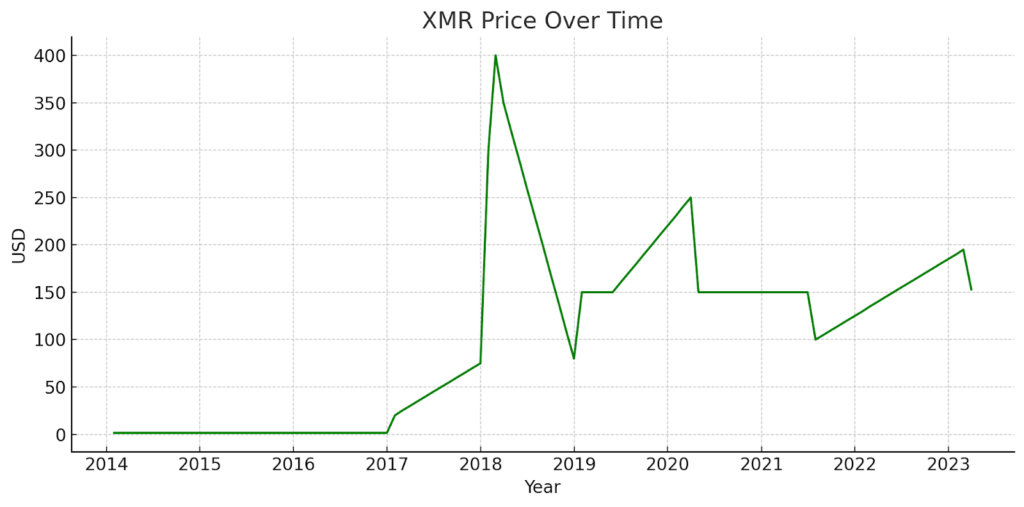

XMR Valuation

The profitability of your mining activities is not as heavily impacted by fluctuations in market price as one might anticipate. Substantial changes in price are necessary to significantly alter the underlying economics. Observing the history of XMR’s value, which appears to have stabilized around $150 for an extended period, as evidenced by the graph showing a consistent price point in this range, it’s reasonable to utilize $150 as a benchmark for financial projections.

Electricity Costs

The expenses associated with electricity exhibit significant fluctuations. In Europe, particularly in regions where the average electricity price exceeds $0.28 per kWh, the prospect of generating profit through Monero mining becomes impractical. However, in the United States, the scenario varies depending on the state.

While California presents a high-cost environment, states like Louisiana, North Carolina, and Texas offer more affordable rates, hovering just above 12 cents per kWh. For those engaging in Monero mining, the choice of location within the U.S. plays a crucial role in determining the feasibility of achieving a profitable margin. Here are the states where Monero miners can anticipate a more favorable profit margin.

| State | Cost of electricity (¢/kWh) |

|---|---|

| Idaho | 10.35 |

| Louisiana | 12.40 |

| North Carolina | 12.50 |

| Texas | 12.79 |

| Utah | 12.78 |

| Washington | 11.67 |

| Washington D.C. | 12.81 |

If you can secure electricity at an even lower rate, it will significantly impact your overall earnings. Take, for instance, the AMD Ryzen 9 7950X, which we previously identified as the optimal CPU for XMR mining. It can yield a 32% Return on Investment (ROI) with a break-even period of 3 years. This assumes an electricity cost of 0.05 cents/kWh, a rate often achievable by large mining farms.

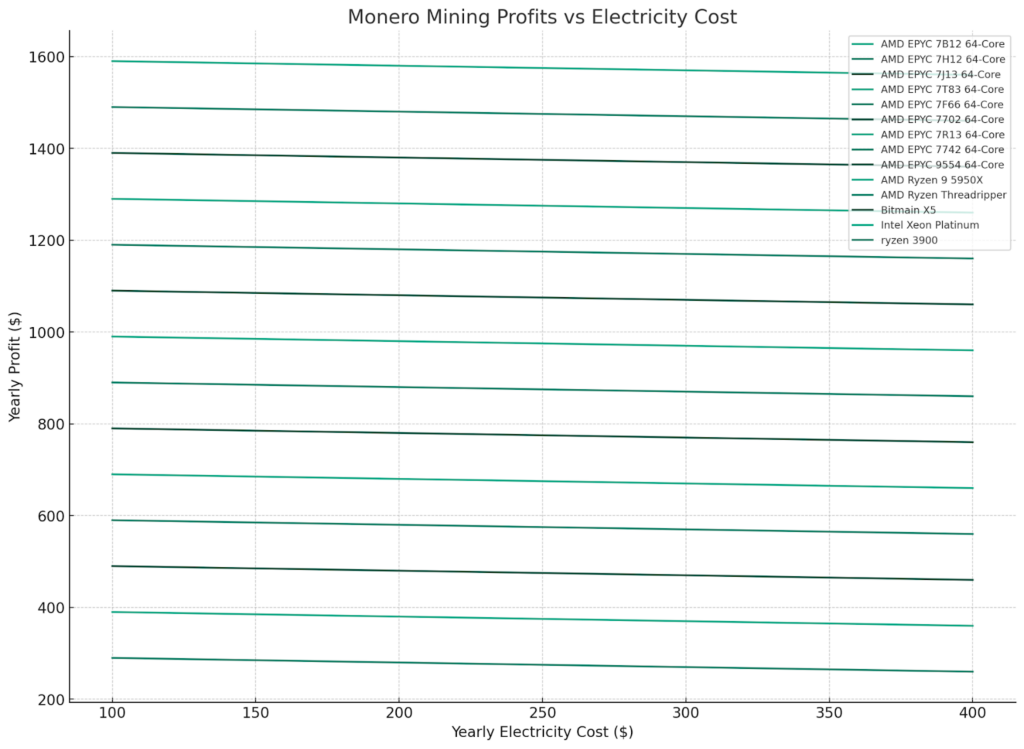

The accompanying graph illustrates the correlation between profitability and rising electricity costs, underscoring the importance of obtaining electricity at an economical rate.

Analysis of Monero Mining Profits and Electricity Costs

The presented graph illustrates the fluctuation in annual profits with increasing electricity costs. It becomes apparent that, for the majority of miners, elevated electricity expenses lead to a negative profit margin. Additionally, caution is advised regarding excessive enthusiasm for the Bitmain X5, as its actual electricity costs are considerably higher and are likely to surpass the chart’s upper limits, given its consumption of approximately 10 times more electricity than other miners.

Dynamics of Mining Difficulty in the Monero Network

Network or mining difficulty in the context of Monero refers to the level of complexity miners face in solving cryptographic problems, a prerequisite for adding new blocks to the Monero blockchain.

- Monero operates on a proof-of-work blockchain, requiring miners to utilize computational power to tackle intricate cryptographic puzzles;

- The mining difficulty is a dynamic metric, fluctuating based on the number of active Monero miners. If miners suspend operations due to unprofitability, the mining difficulty decreases, and conversely, it increases when more miners participate;

- To maintain a consistent block creation rate, the Monero network adjusts its mining difficulty, aiming for a new block to be added approximately every 2 minutes.

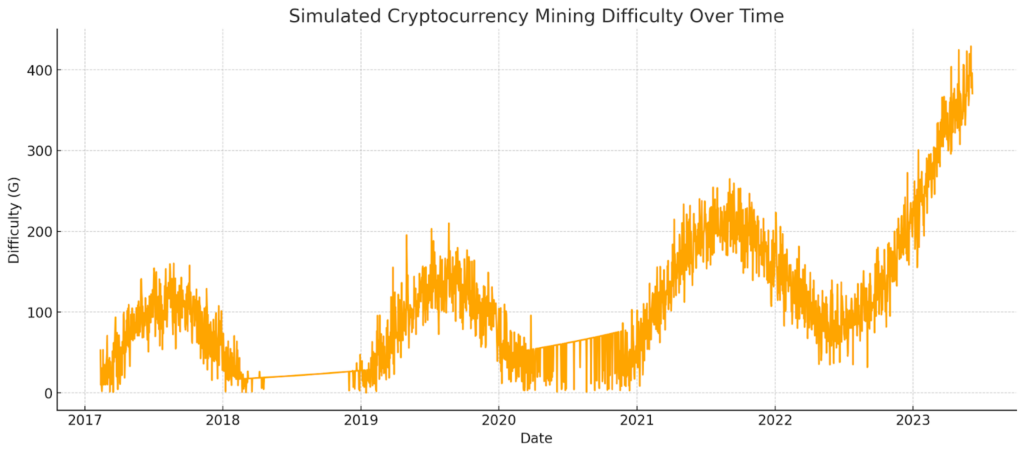

Impact of Mining Difficulty on XMR Profitability

Surprisingly, mining difficulty doesn’t exert a significant influence on your XMR profit margin.

The unit economics of XMR mining demonstrate a lower sensitivity to network difficulty than one might anticipate. For instance, since 2021, the mining difficulty for Monero has remained within the range of 300 to 350 G.

Even in a hypothetical scenario where it increases to 400G, our Return on Investment (ROI) would only experience a marginal decline of 2 percentage points, settling at 13%. Similarly, the break-even period would extend to 7 years instead of 6 in the best-case scenario.

Pools Fees

Cryptocurrency mining presents a choice between two primary approaches: joining a Monero mining pool or opting for independent, solo mining.

Solo mining relies on the miner’s hardware to independently solve complex cryptographic challenges, akin to entering a lottery. The odds of solving a hash within a year might be likened to having a 50/50 chance. The major benefit for solo miners is the retention of the entire mining reward, which could amount to approximately 0.61 XMR. However, the major drawback is the unpredictability of income, which contrasts with the constancy of expenses like electricity bills.

Conversely, pool mining involves collaboration, where individual miners contribute their computational power to a collective and receive a more consistent return. The pool coordinator typically charges a service fee ranging from 1% to 2%. The collective effort of the pool leads to a more evenly distributed reward among its members, proportional to their provided hashing power.

The tendency for large, publicly listed mining entities to favor pool mining has been reflected in this analysis, with the assumption that individual miners might follow suit. It is worth noting that the pool’s service fee is generally a minor factor in the overall profitability equation.

An additional, alternative method is cloud mining, where mining power is leased from a third-party provider. However, due to the prevalence of fraudulent schemes in cloud mining, it has been excluded from this profitability analysis. Caution is advised when considering this option due to the associated risks.

RAM

The quantity of RAM you employ will impact both your hashrate and energy consumption. Explore “How Much RAM Is Required to Mine Monero” for detailed insights.

Cooling Systems

While the CPUs in encountered Monero mining rigs generally perform well with their built-in fans, it’s essential to consider potential additional cooling expenses, particularly in warmer climates.

The Viability of Monero Mining with GPUs and Other Hardware

Exploring the efficacy of GPU mining for Monero reveals that it may not be the most practical choice. GPUs lack the requisite computational prowess for efficient Monero mining, rendering CPU mining as the more feasible option.

Examining ASIC Utilization for Monero Mining

Monero’s commitment to decentralization is reflected in its RandomX algorithm, designed to deter ASIC usage. Despite this, the Bitmain X5 emerged as a machine tailored for XMR mining. Interestingly, it mimics an ASIC’s form but is fundamentally powered by CPUs.

Longevity of CPUs in Mining Operations

Investigating the lifespan of CPUs used in mining, opinions vary. Yet, there is a general agreement that maintaining CPU temperatures below 176°F (80°C) can significantly extend their operational life, potentially up to two decades.

Determining an Optimal Hashrate for Monero Mining

The ideal hashrate for profitable Monero mining is contingent upon the specific hardware in use. A baseline of 15Kh/s is suggested for viable mining operations. For an in-depth examination of the economics, refer to the linked comprehensive analysis.

The Persistence of XMR Mining Despite Modest Gains

Miners continue to engage in XMR mining for several strategic reasons:

- Leverage in Cost Efficiency: Major mining operations harness the power of bulk to drive down costs. Their ability to negotiate more favorable energy rates enhances their competitive edge. Furthermore, these entities are committed to maximizing returns on their substantial initial investments in mining infrastructure by continually harvesting block rewards;

- The Botnet Factor: Discussions on platforms like Reddit suggest that a significant portion of Monero mining is attributed to illicit activities. Hackers reportedly deploy malware to commandeer third-party computing resources for covert mining operations. A study from King’s College indicated that in 2019, botnets contributed to approximately 4.32% of all mined Monero;

- Capitalizing on Underutilized Resources: For organizations with extensive CPU resources, such as data centers, Monero mining offers a way to utilize idle computing power profitably.

In essence, the relative ease of entry into Monero mining and the existence of an established community of miners suggest that profitability may remain slim but consistent, particularly for those who can mine at a larger scale.

Tax Implications of Monero Mining Profits

In jurisdictions like the US and Japan, where cryptocurrency is well-regulated, Monero mining profits are technically taxable. To ensure compliance, it’s essential to treat mining rewards deposited into your Monero wallet as taxable income.

The amount of tax you owe will be contingent on your income bracket. Additionally, you must factor in any capital gains arising from the time you acquire new coins to when you eventually sell them on a cryptocurrency exchange.

Conclusion

Mining Monero can appear to be a less profitable venture compared to several other cryptocurrencies. Several factors, including its reaction to market prices, electricity cost, mining difficulty, and hardware performance, significantly influence its profitability. However, comprehensive knowledge of the Monero mining and cryptocurrency landscape can open up potential avenues for profitability. Large scale mining operations may achieve economies of scale that enhance profitability. Others exploit idle CPU capacity to mine Monero, while some use unauthorized methods, such as botnets. Thus, while the profit margins may seem slim, Monero mining remains a viable operation for diverse reasons.

In the end, the profitability of mining Monero depends on various factors, including the efficiency of the CPU, cost of electricity, mining difficulty, and the current market value of XMR. Even though the returns might seem minimal given the substantial investment required, understanding the dynamics of the market and leveraging idle CPU capacity or other creative methods can make Monero mining worthwhile. Therefore, while it might not yield immediate returns, Monero mining can be viewed as a long-term investment with potential profitability under the right conditions.

FAQ

The AMD Ryzen 9 7950X is notable for its profitability, yielding an annual profit of $103, with an 18% ROI and a breakeven period just shy of 6 years, priced at approximately $581 currently.

Monero is exclusively mineable via CPU due to its ASIC-resistant design, intended to facilitate widespread participation in mining. GPU mining is not economically viable for Monero.

A top-tier CPU for mining Monero can generate an 18% ROI, based on a stable XMR price and optimal electricity rates.

CPUs are the only profitable hardware for mining Monero since GPUs are less effective at processing Monero’s RandomX algorithm.

Monero’s supply is not capped, expanding by 0.6 XMR with each new 2-minute block, which equates to an annual increase of 157,680 XMR.

While possible, laptop mining is inefficient and may lead to overheating issues, making it a less desirable option.

Monero utilizes the RandomX algorithm, which levels the playing field against large mining operations, promoting a more decentralized and equitable mining environment.

A new Monero block is created every two minutes. Solo miners may win a block reward roughly every 2.3 years, while pool miners can expect more frequent but smaller rewards.

With a top-end CPU, you can expect to mine about 0.027 XMR daily, which translates to around $4.27 given the current XMR price.

Individuals can solo mine Monero and potentially receive the full 0.6 XMR block reward plus fees, or join a pool for more regular payouts in exchange for a 1-2% fee.