In the digital currency sphere, Coinbase and Coinbase Wallet stand as two distinct pillars under the Coinbase brand, each catering to different facets of cryptocurrency management. Having been utilized since 2017, these platforms are distinguished by their unique offerings that target varied aspects of user experience in managing digital assets.

At its core, Coinbase functions as a cryptocurrency exchange—a marketplace for buying and selling digital currencies. Conversely, Coinbase Wallet serves as a secure vault, entrusting users with their cryptographic keys and, consequently, their crypto assets.

The foundation of cryptocurrency transactions lies in the crypto address—a public identifier akin to a bank account number, but in the crypto realm. This address, visible on the blockchain, is associated with transaction histories and balances but masks the identity of the owner behind alphanumeric strings.

Public and Private Keys: A Cryptographic Duo

In the cryptocurrency world, the public and private keys are the yin and yang of transaction security. The public address is like a mailbox visible to the public, while the private key is the secret code that unlocks the ability to move funds from that mailbox.

- Delineating Coinbase Exchange’s Role. Coinbase Exchange is the entry point for many into the cryptocurrency market, facilitating the purchase of digital currencies using fiat from a bank account. While users can see their crypto stored at a public address, the private keys remain under Coinbase’s guardianship—a potential vulnerability for the unwary investor;

- The Perils of Exchange-Based Asset Custody. History has shown that even well-regarded exchanges are not immune to failure, with the collapse of FTX serving as a sobering reminder. Such incidents vividly illustrate the risks associated with storing significant cryptocurrency holdings on an exchange.

Embracing Coinbase Wallet for Sovereign Control

Coinbase Wallet emerges as the bastion of security, providing a haven where users can store their cryptocurrencies while retaining the access codes. This autonomous approach ensures that users remain the unequivocal owners of their crypto coins, immune to the perils of exchange bankruptcies.

Delving deeper, a crypto address is not just a random string of characters but a key to the blockchain ledger—a ledger that maintains a transparent record of balances and transactions, yet preserves anonymity.

Upon engaging with Coinbase, users transition from fiat to crypto, acquiring digital currencies that are associated with a public address. However, the absence of private key ownership raises concerns, especially for those whose investments represent a significant portion of their wealth. The reliance on exchanges for asset storage introduces several risks, most notably the potential for an exchange to implode due to mismanagement or market volatility, as the cryptocurrency landscape has witnessed in recent years.

Coinbase Wallet provides a sanctuary for users to exercise self-custody, ensuring they retain ownership regardless of Coinbase’s fortunes. This level of control is paramount, given the irreversibility of transactions and the absolute necessity of safeguarding access codes. Grasping the importance of self-custody is vital. It is the ultimate form of asset control in the cryptocurrency domain, shielding investors from exchange-related risks and empowering them with the independence to manage their funds.

The Coinbase Ecosystem: Exchange and Wallet Coexistence

In the broader Coinbase ecosystem, the exchange and wallet coexist, serving complementary roles—one as a gateway to the crypto market and the other as a personal secure storage solution.

Coinbase’s exchange platform offers a user-friendly interface for purchasing crypto, but the arrangement where Coinbase holds the private keys has significant implications. For casual traders or those with minimal investments, this might pose a negligible risk. However, the narrative changes dramatically for users with life-altering sums invested. Coinbase’s security measures, including cold storage for the majority of assets and insurance against cyber incidents, provide some peace of mind, yet cannot fully mitigate the inherent risks of centralized custody.

The crypto market has not been a stranger to tumultuous events. The fall of FTX, a once-glamorous exchange, exemplifies the precarious nature of storing cryptocurrencies on an exchange platform. The rapid unraveling of such a colossal entity, spurred by liquidity crises and mismanagement, reveals the fragility of relying on external platforms for asset security.

Coinbase Wallet: A Closer Examination

Coinbase Wallet stands as a fortress for those seeking refuge from the uncertainties of exchange-based storage. By entrusting users with their private keys, the wallet insulates them from the fallout of exchange calamities. The security provided by the wallet is as robust as the user’s ability to manage their private keys responsibly—a double-edged sword that offers protection as long as the keys are not lost or compromised.

The Necessity of Understanding Crypto Addresses

Before venturing further, it’s essential to comprehend the significance of a crypto address. This digital identifier is the beacon on the blockchain that signifies ownership and transactional activity, all while preserving the owner’s anonymity through its cryptographic design.

- Operational Mechanics of Coinbase. Initiating transactions on Coinbase begins with fiat conversion, leading to the acquisition of crypto assets that are tied to a public address. But with the private keys held by Coinbase, users must weigh the convenience against potential risks;

- The Implications of Not Holding Private Keys. Not holding one’s private keys can present a dilemma. For those with smaller holdings, the risk might be manageable, but for those with substantial savings, the stakes are much higher. Coinbase’s operational integrity, underpinned by its cold storage practices and insurance, does offer a layer of defense, yet it is not infallible;

- The Risks of Centralized Storage. The most daunting risk is the catastrophic failure of the exchange, a scenario not beyond the realm of possibility as the FTX incident has shown. The risk of the exchange facing operational hurdles or imposing withdrawal restrictions is a constant threat in the volatile crypto market;

- The Protective Shield of Coinbase Wallet. Utilizing Coinbase Wallet fortifies a user’s defense against such exchange-related adversities. The wallet’s function is straightforward: safeguard the user’s crypto assets by providing them with the only set of keys to their digital vault;

- The Role of User Responsibility. The migration to a personal wallet like Coinbase Wallet shifts the onus of responsibility onto the user. The private keys are the user’s charge, representing both the power of transactional freedom and the burden of security.

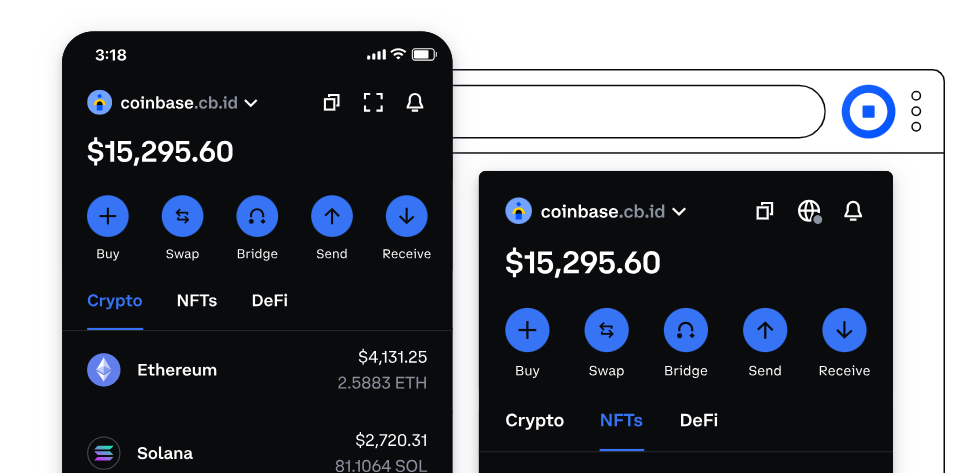

Navigating the Coinbase and Coinbase Wallet platforms is a strategic endeavor that requires a balance between the ease of an exchange and the security of self-custody. Users must assess their comfort with risk, the magnitude of their holdings, and their ability to manage private keys when deciding where to store their cryptocurrency. As the digital currency landscape evolves, staying informed and adaptively managing one’s assets becomes not just prudent, but necessary for safeguarding one’s digital wealth. Coinbase Wallet serves as a self-custody digital wallet, offering users autonomy over their private keys while integrating with decentralized applications (DApps). It caters to those who prioritize security and control in managing their digital assets. Within the wallet, users can store a variety of cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and a multitude of ERC-20 tokens.

The wallet extends its functionality beyond storage, enabling users to directly engage with DApps, which include decentralized finance (DeFi) platforms and lending services, thanks to its in-built Web3 browser. Security is paramount in Coinbase Wallet, which incorporates secure enclave technology and biometric authentication methods to reinforce the safeguarding of private keys.

The Link Between Coinbase and Coinbase Wallet

Despite the shared origin, Coinbase and Coinbase Wallet serve different market segments. The wallet allows for easy transfer of funds from another wallet or a linked Coinbase account using the “Coinbase Pay” feature. This connection, however, does not make it fully decentralized, as the term often implies ownership of keys and the ability to connect to DeFi DApps. This is a misconception, as the wallet’s decentralization pertains to user experience rather than the community-driven development of the app.

Coinbase Wallet’s Swap Feature and User Experience

The swap feature in the Coinbase Wallet’s mobile app mirrors the experience users have on decentralized exchanges like Uniswap or Pancake Swap. However, the term “decentralized” can be misleading as it could imply that the app is managed by a developer community, which is not the case for Coinbase Wallet; it is developed and maintained by Coinbase, which has commercial interests in the app’s success. The security of the wallet is only as strong as its code, and vulnerabilities could lead to asset loss, similar to incidents seen with other wallets like Atomic Wallet.

Key Differences Between Coinbase and Coinbase Wallet

- Coinbase: A Gateway for Beginners. Coinbase operates as a user-friendly centralized exchange, perfect for novices to buy, sell, and engage with cryptocurrencies. It’s known for its intuitive interface that simplifies the entry into the crypto ecosystem;

- Coinbase Wallet: Secure Storage and DeFi Access. Contrastingly, Coinbase Wallet is tailored for the secure storage of cryptocurrencies and engagement with the DeFi sector. It allows for a broader range of activities, including staking, governance participation, and direct DApp interactions, making it suited for the more seasoned crypto aficionados;

- Adding Funds and Cashing Out on Coinbase. Coinbase supports direct fiat currency transactions, allowing users to link bank accounts for seamless currency conversion. Unlike Coinbase Wallet, it facilitates easy transitions between fiat and crypto;

- Comparing Fees. Coinbase and Coinbase Wallet diverge on transaction fees. Coinbase implements a variable fee structure for trades, while Coinbase Wallet does not charge for transfers but incurs fees when interacting with DApps or blockchain networks;

- Customer Support Services. Coinbase boasts a comprehensive customer support system, whereas Coinbase Wallet, as a self-custodial solution, lacks integrated support, directing users to the broader Coinbase support for assistance;

- Range of Cryptocurrencies for Swapping. Coinbase Wallet provides swapping capabilities within certain blockchains. Unlike Coinbase, it does not support direct trading of Bitcoin but allows for the exchange of wrapped Bitcoin on Ethereum through integrated decentralized exchange services;

- No KYC Required for Coinbase Wallet. Setting up a Coinbase Wallet does not necessitate an email, bank account, or even a Coinbase account. It operates solely with a seed phrase and user-provided funds.

Closing Insights on Coinbase and Coinbase Wallet

The differentiation between Coinbase and Coinbase Wallet lies in their target user base and scope of services. Coinbase simplifies the trading process for beginners, while Coinbase Wallet offers advanced features for users seeking a more robust and independent cryptocurrency management experience. Each platform plays a pivotal role in the diverse ecosystem of digital asset trading and storage, catering to the specific needs and expertise levels of various users.

Comprehensive Steps for Initiating a Coinbase Wallet

Introduction to Setting Up a Coinbase Wallet

Coinbase Wallet provides a digital haven for cryptocurrency users, compatible with Android and iOS mobile devices and as a Chrome browser extension. The setup process mirrors across devices, beginning with a critical security feature: the seed phrase.

Step 1: The Seed Phrase Protocol

In the world of digital wallets, the private key’s complexity is distilled into a more manageable form known as the seed phrase. For new users setting up their Coinbase Wallet, the platform issues a 12-word seed phrase. This mnemonic phrase, a simplified representation of the private key, is crucial for account recovery and security. It employs cryptographic principles to allow recovery of private keys, hence securing it is as vital as safeguarding the keys themselves. Users are advised to store their seed phrase in a location impervious to digital threats—an offline device or physical paper in a safe place. The horror stories of individuals scouring landfills for discarded devices holding precious keys underscore the necessity of meticulous storage.

Step 2: Creating a Secure Password

Beyond the seed phrase, the wallet prompts users to create a password. This password is for daily transactions, contrasting with the seed phrase, which is reserved for wallet recovery scenarios, such as syncing the Chrome extension with a mobile application.

The Process of Creating a Coinbase Account

Distinct from the wallet setup, creating a Coinbase account is a process laden with regulatory compliance. Identity verification aligns with KYC standards, and once complete, users establish a password and enable two-factor authentication to enhance security. This step paves the way for fund transfers from a user’s bank account, leading to the commencement of crypto trading. Notably, this process does not involve a seed phrase or private key distribution, marking a significant divergence from the wallet setup and underscoring the differences between the exchange platform and the self-custody wallet service.

Alternatives to Coinbase Wallet

Exploring the Landscape of Wallet Options

Within the cryptocurrency ecosystem, users can choose from a plethora of wallets. Renowned alternatives to Coinbase Wallet include MetaMask, Trust Wallet, and Exodus, each with its unique features and security measures. For those seeking a greater degree of security, hardware wallets like Nano Ledger or Trezor devices offer an extra layer of protection.

Unlike their software counterparts, hardware wallets must be procured through purchase, but they offer unrivaled security. These devices provide peace of mind, especially for substantial holdings, by enabling cold storage—offline custody of crypto assets, which is less susceptible to online threats.

For users who prefer not to manage their security measures entirely, Coinbase offers the Vault—a hybrid storage solution that combines the security benefits of cold storage with the ease of use of a hot wallet. The Vault incorporates security features such as a mandatory waiting period for withdrawals and the option for multiple approvers, enhancing the security for users who store their digital assets on Coinbase.

- On the Insurability of Coinbase Wallet Funds. It’s crucial to note that assets within a Coinbase Wallet are not insured, which places the onus of risk squarely on the user’s shoulders. This risk encompasses all aspects of wallet security, including the potential for hacking;

- Transferring Assets for Enhanced Security. Users with significant cryptocurrency investments often consider transferring their assets to a Coinbase Wallet or a hardware wallet as a more secure alternative than leaving them on the Coinbase exchange. This transfer is a strategic move towards greater security, providing a robust defense against the myriad of online threats.

The Relationship Between Coinbase and Its Wallet. While holding a Coinbase Wallet is not a precondition for having a Coinbase account, it serves distinct purposes. The wallet is for users who wish to assume full custody of their assets and partake more actively in the decentralized finance space.

- Assessing the Safety of Coinbase Wallet. The perception of safety associated with Coinbase Wallet stems from the self-custody of funds it offers. Yet, it’s imperative to understand that self-custody does not inherently insulate the wallet from the risk of hacking;

- The Utility of Coinbase Wallet. The Coinbase Wallet is favored for its ability to store substantial funds while providing access to private keys. Users leverage the wallet to dive into DeFi activities, such as lending or earning yields, enhancing their participation in the broader cryptocurrency economy;

- Liquidating Assets from the Wallet. To convert assets to fiat currency, users must transfer funds from the Coinbase Wallet to an exchange that supports such transactions. This step is necessary because direct cash-outs are not a functionality of the Coinbase Wallet.

Selling Cryptocurrency via Coinbase Wallet

Coinbase Wallet offers a swap function that allows users to exchange one cryptocurrency for another. However, this function does not support direct sales of Bitcoin and is limited to specific blockchains and tokens within the same chain.

In the event of a Coinbase failure, the independent nature of Coinbase Wallet ensures the security of the funds within. The wallet’s autonomy from the exchange means that developers do not have access to a user’s funds, providing a bulwark against exchange-related issues. Although Coinbase Wallet does not impose its own transaction fees, users are responsible for paying network fees and third-party exchange fees when using decentralized exchanges accessed via the wallet.

In Summary: The Coinbase Wallet and Its Place in Crypto Security

The narrative of the Coinbase Wallet unfolds as a tale of user empowerment, security, and autonomy. It offers a different approach to cryptocurrency management compared to the Coinbase exchange, with its seed phrase protocol and self-custodial design. As users navigate the crypto ecosystem, they must weigh the convenience of exchanges against the security of wallets, considering factors such as asset size, risk tolerance, and the desire for control over private keys. The choice between using Coinbase Wallet, a hardware wallet, or the Vault service reflects a strategic decision aligned with personal security preferences and investment goals. In the evolving landscape of cryptocurrency, the importance of informed choices and proactive asset management continues to grow, underscoring the need for vigilance and responsibility in the digital age.